US Digital Ad Spending Will Surpass Traditional in 2019

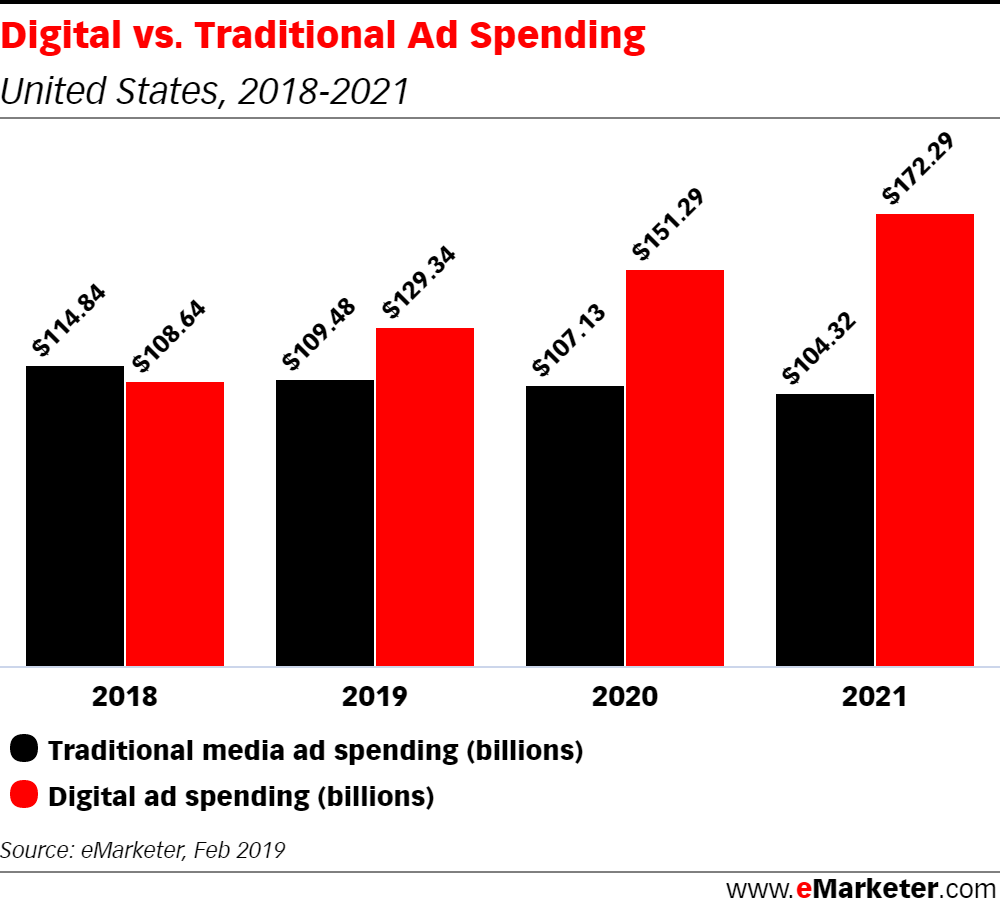

This year will mark a major milestone in the world of advertising. For the first time, digital ad spending in the US will be greater than traditional ad spending, according to eMarketer's latest forecast. By 2023, digital will exceed two-thirds of total media spending.

DIGITAL AD SPENDING

Total digital ad spending in the US will grow 19.1% to $129.34 billion this year, surpassing traditional spend by nearly $20 billion. That means digital now accounts for 54.2% of total US ad spending. Mobile now makes up more than two-thirds of digital ad spending, totaling $87.06 billion in 2019.

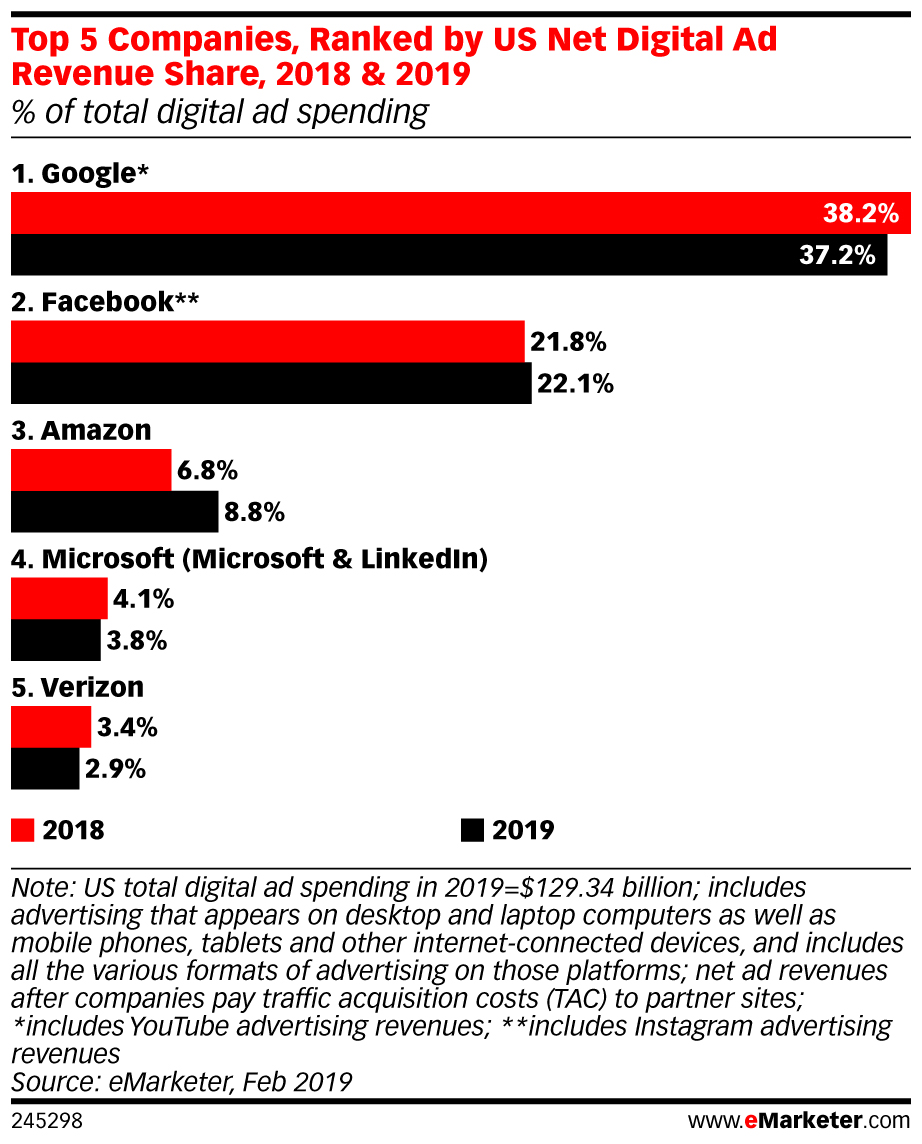

For the first time this year, the combined share of the duopoly (Google and Facebook) will drop, even as their revenues grow. Google's share will drop this year to 37.2% from 38.2% last year. Facebook's share remains virtually unchanged at 22.1% vs. 21.8% last year.

"Instagram is driving most of Facebook's overall share increase," said eMarketer principal analyst Debra Aho Williamson. "There's strong demand for ads in Instagram Stories, and Instagram still benefits from the perception that it's less impacted by the challenges core Facebook has faced."

The big winner this year will be No. 3 player Amazon*, which continues to siphon share from the duopoly. Its US ad business will grow more than 50% this year. Its share of the US digital ad market will swell to 8.8% in 2019, reaching nearly 10% by next year. eMarketer has adjusted its projections higher for Amazon following its Q4 earnings report, putting it on track to close the gap with No. 2 Facebook.

"Amazon has a major benefit to advertisers, especially consumer packaged goods and direct-to-consumer brands," said eMarketer forecasting director Monica Peart. "The platform is rich with shoppers' behavioral data for targeting and provides access to purchase data in real-time. This type of access was once only available through the retail partner, to share at their discretion. But with Amazon's suite of sponsored ads, marketers have unprecedented access to the ‘shelves' where consumers are shopping."

TRADITIONAL AD SPENDING

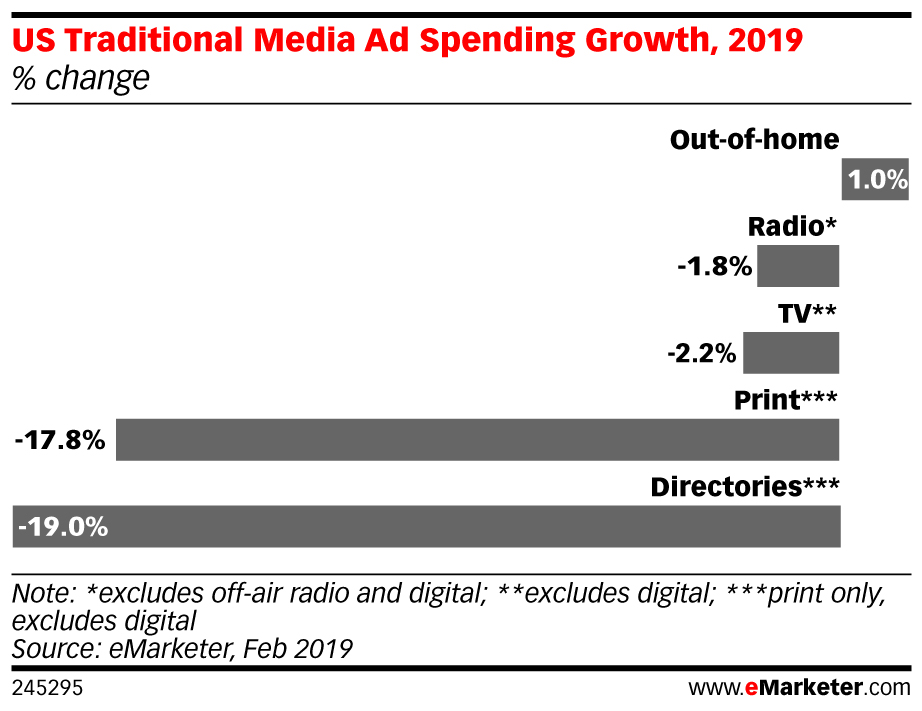

Where are the digital dollars coming from? Directories, such as the Yellow Pages, will take the biggest hit-down 19% this year. Traditional print (newspapers and magazines, excluding online versions) spending is a close second, which will drop nearly 18%. Overall, traditional ad spending's share in the US will drop to 45.8% in 2019, from 51.4% last year.

"The steady shift of consumer attention to digital platforms has hit an inflection point with advertisers, forcing them to now turn to digital to seek the incremental gains in reach and revenues which are disappearing in traditional media advertising," Peart said.

TV ad spending will decline 2.2% to $70.83 billion this year, largely because there are no elections or big events, such as the Olympics or World Cup. The presidential election next year will propel TV ad spending back into positive growth, before falling again in the following years.

*Amazon surpassed Microsoft in 2018 to become the third biggest ad publisher in the US.

Methodology

eMarketer's forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

About eMarketer

Founded in 1996, eMarketer is the first place to look for research about marketing in a digital world. eMarketer enables thousands of companies worldwide to understand marketing trends, consumer behavior and get the data needed to succeed in the competitive and fast-changing digital economy. eMarketer's flagship product, eMarketer PRO, is home to all of eMarketer's research, including forecasts, analyst reports, aggregated data from 3,000+ sources, interviews with industry leaders, articles, charts and comparative market data. eMarketer's free daily newsletters span the US, EMEA and APAC and are read by more than 200,000 readers globally. In 2016 eMarketer, Inc. was acquired by European media giant Axel Springer S.E.

Industry Announcements's article first appeared on OnlineVideo.net