U.S. Digital Ad Revenue Climbs to $57.9 Billion in First Half 2019, Up 17% Yoy, According to IAB Internet Advertising Revenue Report

Report Cautions: Patchwork of State Data Regulations Could Impede Growth in 2020

NEW YORK, NY(21 Oct 2019)

U.S. digital advertising revenues reached $57.9 billion during the first six months of 2019—the highest spend in history for the first half of the year—according to the latest IAB Internet Advertising Revenue Report released by IAB and prepared by PwC US. The record-breaking total marks a 17 percent year-over-year increase from the first half of 2018. While increased growth is continuing in digital, the report also cautions that resources associated with complying with the California Consumer Privacy Act (CCPA) and the myriad of other data regulations proposed by states will likely have a negative impact on businesses in the digital marketplace.

“The uptick in revenues continues to be significant. IAB has joined forces with Privacy for America to advocate for national laws that will make it easier to protect consumer privacy, while continuing to fuel the digital economy,” said Randall Rothenberg, CEO, IAB. “Further, innovation will likely be stifled when companies are forced to redirect resources to comply with an unwieldy patchwork of state-by-state regulations.”

Key drivers of the revenue growth are spotlighted in the report: video advertising was cited as a major contributor to growth, with spend climbing 36 percent year-over-year to a total of $9.5 billion for 1H 2019. With the growing pool of cord-cutters and cord-nevers continuing to drive the expansion of connected television (CTV), social video stories and other forms of non-traditional video content have advertisers increasing their investment in CTV.

Other highlights from the report include:

- Mobile advertising continues its explosive growth, reaching $40 billion for the first half of the year—a 29% increase from the $30.9 billion spent on mobile during the same time period in 2018

- Audio advertising spend is rising with the emergence of smart speakers, up 30% year-over-year to a total of $1.2 billion for the first six months of 2019

- Advertisers spent $1.7 billion on rich media ads during the first half of the year, 20% more than they did during the first half of 2018

“Digital video growth has played a key role in giving 2019 the strongest opening six months in digital’s history,” said Sue Hogan, Senior Vice President, Research and Analytics, IAB. “Increasingly, advertisers are turning to social video stories and connected TV to reach a growing audience of ‘cord-nevers’—a younger cohort who’ve never subscribed to cable television and cannot be reached via linear TV ads. Indicators show CTV and addressable TV are on the rise.”

“Our latest report confirms that the digital advertising industry remains one of the strongest and most dynamic sectors of the U.S. economy. At nearly 17 percent growth from the prior half year, the digital advertising industry is still far outpacing all other ad supported mediums. However, the pace of growth is showing signs of slowing. As smartphone ownership nears saturation and social media matures, the industry is focused on new channels for growth such as connected TV, augmented reality, and the vast potential of 5G."

IAB 2019 Half Year Report - Media Alert

Comparison of 2019 and 2018 Data

(in millions)

| Revenue (Ad Formats) |

Full Year 2017 |

Half Year 2018 |

| |

% |

$ |

% |

$ |

| Search (Mobile and Desktop) |

45% |

$25,961 |

46% |

$22,823 |

| Banner (Mobile and Desktop) |

31% |

$17,835 |

32% |

$15,743 |

| Digital Video Commercials (Mobile and Desktop) |

16% |

$9,512 |

14% |

$7,012 |

| Other (Mobile and Desktop) |

8% |

$4,610 |

8% |

$3,963 |

| Classifieds and Directories |

3% |

$1,862 |

3% |

$1,597 |

| Lead Generation |

3% |

$1,531 |

3% |

$1,380 |

| Audio |

2% |

$1,217 |

2% |

$935 |

| |

|

|

|

|

| Total |

100% |

$57,918 |

100% |

$49,541 |

| Revenue (Desktop v Mobile) |

Full Year 2017 |

Full Year 2018 |

| |

% |

$ |

% |

$ |

| Desktop |

31% |

$17,965 |

38% |

$18,591 |

| Mobile |

69% |

$39,953 |

62% |

$30,949 |

| |

|

|

|

|

| Total |

100% |

$57,918 |

100% |

$49,541 |

| Revenue (Pricing Models) |

Half Year 2017 |

Half Year 2016 |

| |

% |

$ |

% |

$ |

| Impression-based |

36% |

$20,692 |

34% |

$17,078 |

| Performance-based |

62% |

$35,964 |

61% |

$30,198 |

| Hybrid |

2% |

$1,262 |

5% |

$2,264 |

| |

|

|

|

|

| Total |

100% |

$57,918 |

100% |

$49,541 |

Banner includes: Ad Banners/Display, Rich Media, and Sponsorship

Note: Totals may not equal 100% due to rounding

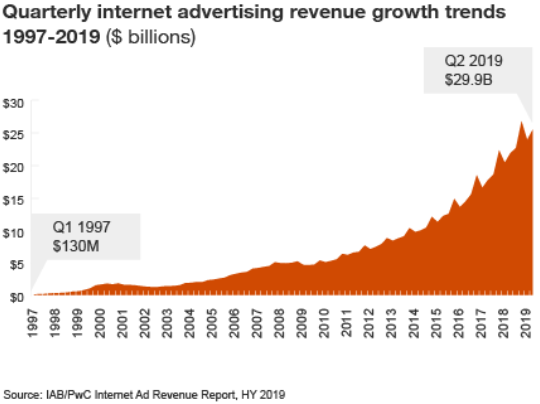

The following chart highlights quarterly ad revenue since IAB began measuring it in 1996; dollar figures are rounded.

IAB sponsors the IAB Internet Advertising Revenue Report, which is conducted independently by the New Media Group of PwC. The results are considered a reasonable measurement of interactive advertising revenues because the data is compiled directly from information supplied by companies selling advertising on the internet. The survey includes data concerning online advertising revenues from websites, commercial online services, free email providers, and all other companies selling online advertising.

PwC does not audit the information and provides no opinion or other form of assurance with respect to the information. Past reports are available at www.iab.com/adrevenuereport.

About PwC US

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 158 countries with more than 236,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.?

About IAB

The Interactive Advertising Bureau (IAB) empowers the media and marketing industries to thrive in the digital economy. Its membership is comprised of more than 650 leading media companies, brands, and the technology firms responsible for selling, delivering, and optimizing digital ad marketing campaigns. The trade group fields critical research on interactive advertising, while also educating brands, agencies, and the wider business community on the importance of digital marketing. In affiliation with the IAB Tech Lab, IAB develops technical standards and solutions. IAB is committed to professional development and elevating the knowledge, skills, expertise, and diversity of the workforce across the industry. Through the work of its public policy office in Washington, D.C., the trade association advocates for its members and promotes the value of the interactive advertising industry to legislators and policymakers. Founded in 1996, IAB is headquartered in New York City.