The State of Video Monetization 2022

The pandemic cemented and accelerated the worldwide shift to streaming, and it initiated a resurgence in the advertising market across the range of streaming platforms. Despite a dip since the height of global lockdown, the market remains strong. The majority of American homes—52%, according to Ampere Analysis—have three or more streaming subscriptions, and more than a quarter of households (29%) have five or more services.

High demand for exclusive and original programming has pumped up costs to a level that means most streaming services will not be profitable for several years. According to S&P Global Market Intelligence, even Disney+ is not expecting to be profitable until FY2024. To that end, expect to see more subscription video-on-demand (SVOD) services rolling out ad-supported tiers, as HBO Max did in June 2021. Meanwhile, the lack of an authoritative and consistent metric spanning the range of CTV platforms continues to brake ad spend on digital.

Here's the global perspective, summed up by Ampere Analysis co-founder and director Guy Bisson: "We're at the stage where most households have multiple paid streaming [services] and multiple ad-supported streaming services that all these distinctions between AVOD, SVOD, linear, BVOD [broadcast video on demand], and FAST [free ad-supported TV] are irrelevant. As far as the consumer is concerned, it's all television. So, at that point, we just need to call it TV. The migration is a tech shift, not a business or economic shift."

Combating OTT Customer Churn

According to a report from Deloitte Insights, the volume of content choice, the ease of canceling, and a desire to manage cost means that SVOD churn will be as high as 30% in 2022. With content costs also at all-time highs—Disney+ plans to spend $33 billion in 2022—major streamers need to adapt their business models, market to market, to keep in the game. Churn is happening at the same time as consumers continue to build their average number of streaming subscriptions. According to Deloitte Insights, these are all signs of a competitive and maturing SVOD market.

The Deloitte Insights report says, "Churn has been most marked in the United States, where SVOD has the highest adoption and the most services launched. … [Consumers] have become overwhelmed by managing and paying for all those subscriptions, and they have become more sensitive to their cost. These conditions can drive customers to cancel subscriptions and/or seek less expensive ad-supported offerings, both to manage costs and as a way to pay only for the content they want by adding and cancelling services as needed."

The result is that about 80% of domestic households had a paid SVOD subscription in 2021, with a churn rate around 35%. This aligns with the conclusions of a Screen Engine/ASI survey, which found that 32% of U.S. consumers were planning to cancel at least one of their streaming services in the first half of 2021.

"Providers seeking to retain customers through the strength of their content are spending billions of dollars annually to develop and acquire top-tier programming," says the Deloitte Insights report. "But it may not be sustainable to spend so heavily, and consumers will only take so many price hikes. More US SVOD providers are hence looking to pricing as another lever to fight churn, offering cheaper or free ad-supported packages." The report's prescription for the SVOD dilemma is to take a page from the strategies of overseas streamers. In particular, it highlights China's iQiyi and India's Hotstar as potential models for U.S. SVODs to follow.

iQiyi has 500 million viewers and 100 million paid subscribers, while Hotstar has 300 million active users, 46.4 million of whom are paid subscribers. The report says, "These services offer multiple pricing tiers from free to premium; their focus is on upselling free ad-supported users into a paying tier, betting that this subscriber revenue will balance out potentially higher content and acquisition costs."

With 100 million paid subscribers and 500 million viewers overall, China’s iQiyi platform provides a useful model for succeeding with OTT on a global scale.

In addition, notes the Deloitte Insights report, these platforms also offer multi-service bundles that include innovative content and advertising, gaming, music, and mobile-first engagement. "This array of services allows providers to aggregate very large audiences and monetize them in various ways, not just through subscriptions and video, and it can also help insulate them from churn."

AVOD Growth

U.S. viewers now spend more time with AVOD and OTT content aggregators (such as Sling, Hulu, and Roku) than with SVOD, according to the TVision report, "The State of CTV." It found that between Q1 2021 and Q3 2021, time spent on SVOD decreased by 8.6%, while time spent on AVOD increased by 9.3%.

Although households reduced the number of streaming apps they had in early 2021 (from 7.7 in Q4 2020 to 7.2 in Q1 2021), that number has since begun to increase again. In Q3 2021, households had 7.5 apps installed. In fall 2021, nearly 30% of U.S. households had 10 or more apps installed on their main television.

The report notes, "As we close out 2021, it is clear that this was a year of transformation across the streaming ecosystem. On the advertising side, questions of whether consumers would embrace ad-supported streaming television largely dissipated as viewers now spend more time with AVOD than SVOD, and dMVPD providers also represent a growing share of streaming viewing time."

FAST Forward

As SVOD matures, growth will be increasingly driven by ad-supported models. Among them, FAST channels experienced noteworthy growth in 2021. A FAST service provides free TV channels that look like traditional "live" television to consumers. These channels are called virtual linear (vLinear) because they are typically created using a playlist of video-on-demand assets, sometimes blending in live events.

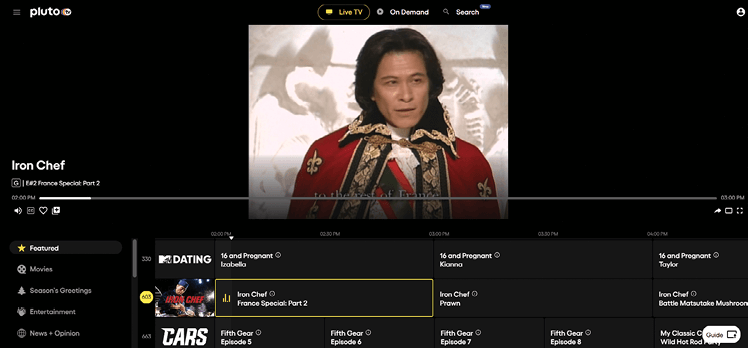

ViacomCBS's Pluto TV is arguably the leader in the FAST market. It launched in early 2014 and took 6 years to reach 16 million monthly active users in the U.S., but that total has almost doubled in the last 2 years.

Eight years in, Pluto TV remains tops in the FAST market.

Other FAST services—including Xumo and The Roku Channel—have enjoyed similarly explosive growth. All of the major smart TV manufacturers now have built-in FAST services. Some services, such as Peacock and Amazon's IMDb TV, are primarily on demand, with some vLinear channels.

Horowitz's "State of Viewing and Streaming" report for 2021 says that 28% of U.S. TV viewers are already using a FAST service at least monthly in addition to their on-demand offerings. And an Edgecast white paper analyzing the trend notes, "While Netflix is the most popular SVOD service in the US, it does not provide the right experience for all its members all the time.

According to comScore, peak Netflix viewership days are Saturday through Tuesday, with Wednesday through Friday seeing much lighter use. Are Netflix subscribers taking a break from TV? Likely not." Some are switching to vLinear services. The white paper says, "It could be that the linear format works better for people in the middle of the work week. When people finish their workday, rather than rummage through a huge on-

demand catalog, many would rather have someone else choose what they should watch next."

While FAST and AVOD services might be presumed to attract older viewers, some are also targeting younger consumers by originating their own content rather than distributing catalog titles on curated channels. Tubi, Fox's ad-supported streaming service, which claims an average audience age of 37, 20 years younger than that of linear TV, debuted a 140-hour slate of originals in fall 2021. And Roku launched Roku Originals in May 2021, built out of programming from the now-defunct Quibi.

Speaking during Viacom's first-quarter 2021 earnings call, CEO Bob Bakish described Pluto TV as "an incredible growth engine" for his company: "The expanding engagement attracts more and better content and advertisers, which drives up ad values and fill rates. In other words, the industry is locked in a virtuous cycle, one that certainly seems to have a lot of room to run."

The Evolution of TV

After national TV ad spend declined by 6.9% in 2020, according to GroupM, the agency now projects it to have grown by 8.7% in 2021. Talk of the death of TV is not only misleading; it's plain wrong, according to advertising strategists at major U.S. networks.

"We need to stop predicting the death of television," said Dan Aversano, SVP of data analytics and advanced advertising for Univision, during "The Golden Age of TV Advertising in an OTT-First Future: What an OTT-First Future Means for TV Advertising," a Variety-hosted panel. "It is the evolution of the ecosystem. When we say ‘TV,' that doesn't just mean over-the-air linear viewing," Aversano explained. "It means consuming long-form premium content wherever we distribute that. The TV business is as healthy and robust as ever. It's just being redefined."

Brendan Murnane, SVP of digital sales strategy for ViacomCBS, agreed, noting that Thanksgiving weekend (with NFL games and the Showtime hit drama Yellowjackets) was a great reminder of the power of linear TV to still bring in a massive concurrent audience. "It's far from the death of TV," Murnane commented. "But the ad experience on TV and mobile are extraordinarily different. It is nice to try to lump them together, but the reality is it is incredibly complicated."

Also in the panel, Mark Douglas, president and CEO of MNTN, the developer of a CTV advertising platform, shared some striking stats measuring the effectiveness of TV as an ad medium. "If I book an ad against a show on A&E, it will outperform an ad against a web video by over 1,000%," said Douglas. "It's night and day. You can compare that to YouTube. Pre-rolls don't perform. People who are really engaged with a show on TV will respond to those ads 1,000% more than will any web video ad anywhere, including YouTube."

Those stats come from a business that targets TV advertisers. Other reports suggest that consumers are more open to advertising on streaming services than they are on traditional linear. Horowitz, for example, finds that about half of streamers go out of their way to avoid advertising on TV, but are more tolerant of ads when watching streamed content that is available for free (or at low cost). In addition, nearly four in 10 consumers are starting to notice and appreciate the more customized, personalized advertising experience they can get through streaming.

"The fundamentals of the industry haven't changed," says Adriana Waterston, SVP of insights and strategy for Horowitz. "When delivered in the screen-agnostic, watch-anywhere, and highly personalized viewing experience of the streaming environment, we are seeing some consumers not just tolerating, but welcoming advertising, particularly when it is customised to their interests."

Converged TV Is Approaching

The bigger picture is that it's not TV versus digital so much as TV means digital, whatever the distribution platform. Broadly speaking, although the trajectory in ad-land is toward converged TV strategies, converged TV is the idea that "television" is transforming from a linear, device-centric medium to one defined by screen-agnostic, addressable, premium content. "The State of Converged TV: A Look at Global Trends & Adoption," a report from TV measurement firm TVSquared, found that 75% of marketers across the U.S., U.K., Germany, and Australia agree that TV is now defined as linear and streaming platforms.

The ability for advertisers to reach consumers watching video shot up in the first half of 2021, with connected TV the most likely screen to catch them on, according to Integral Ad Science (IAS) in its "H1 2021 Media Quality Report." IAS found that "video ad viewability" rose across all screens (desktop, mobile, CTV) and most markets globally. "We're starting to see the streaming ecosystem as a ‘must-have' in the advertiser's media mix versus an afterthought pre-COVID," Kristina Shepard, head of agency partnerships and national brand team lead for Roku, said in the Variety panel.

In 2020, ViacomCBS launched EyeQ in an attempt to consolidate Viacom, CBS, and Pluto TV as a single unified ad stack. "It gives us the ability to deliver flexibly across all our endpoints and simplify the buying experience," explained Murnane in the Variety panel. "We've captured tremendous growth."

Related Articles

What does the future of streaming monetization look like? This post-Peak TV media ecosystem is a brave new world, and being able to find the content you want, with the price you want to pay, will likely keep consumers on their toes for years to come.

04 Apr 2024

Streaming media business and monetization models expanded and diversified in 2022 and sent a clear message: Paid subscription models were a necessary gateway to widespread streaming adoption, but now ad-supported viewing has a chance to flourish.

12 Apr 2023

As the free ad-supported television (FAST) market gets ever-more crowded, companies that leverage their data in the smartest ways will thrive while others fall by the wayside.

08 Mar 2022

This potential for innovation and accessibility truly sets FAST platforms apart from both traditional over-the-air linear and on-demand streaming platforms. Over the coming years, we will increasingly see that impact as more device manufacturers and VOD platforms, both ad-supported and paid, enter the space, providing an ever more diverse set of curated and personalized linear channels to their users.

17 Nov 2021

Pluto TV CTO & EVP Vibol Hou discusses Pluto TV's evolution from an AVOD OTT service to a FAST provider in this clip from an interview with Streaming Media's Eric Schumacher-Rasmussen at Streaming Media West 2021.

15 Nov 2021

Axios Media Reporter Sara Fischer provides the lay of the land for VOD monetization in late 2020 and beyond, including the rise of FAST services and the resurgence of free OTA.

16 Dec 2020

How exactly do organizations generate video-based revenues? A new report from Streaming Media, Unisphere Research, and Amazon Web Services sheds light on subscription vs. advertising vs. transactional, SSAI, and more.

19 May 2020

It's no longer SVOD vs. AVOD, and innovative approaches to both content, subscription formats, and advertising are generating new revenue streams for every business model.

03 Apr 2020

Companies and Suppliers Mentioned